TRX Price Prediction: Can Bulls Push TRX to $0.40?

#TRX

- Technical Alignment: Price above 20-day MA with Bollinger Band squeeze suggests breakout potential

- News Catalyst: Buyback program and legal developments may increase volatility

- Risk/Reward: Favorable for swing traders if $0.3377 support holds

TRX Price Prediction

TRX Technical Analysis: Bullish Signals Emerge

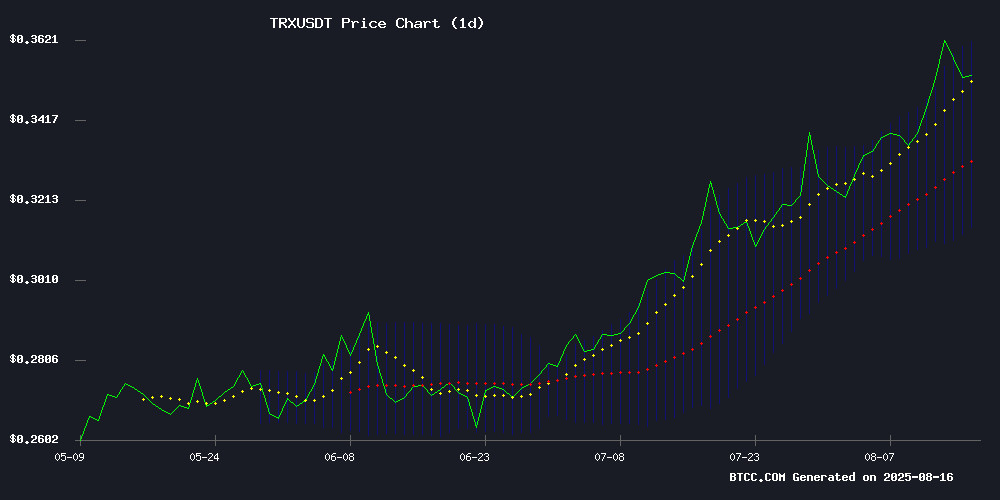

According to BTCC financial analyst Mia, TRX is currently trading at 0.34610000 USDT, above its 20-day moving average (MA) of 0.337780, indicating a potential bullish trend. The MACD histogram shows a slight bearish crossover but remains close to the signal line, suggesting consolidation. Bollinger Bands indicate the price is NEAR the upper band (0.360800), which could signal overbought conditions in the short term. However, the overall technical setup leans bullish if TRX holds above the 20-day MA.

TRX Market Sentiment: Optimism Amid Consolidation

BTCC financial analyst Mia notes that TRX's market sentiment is cautiously optimistic, driven by headlines suggesting a potential breakout to $0.37-$0.40. News of Justin Sun's legal actions and TRON's buyback program adds volatility but doesn't overshadow the technical bullishness. Futures and on-chain metrics appear aligned for upward momentum, though overbought signals warrant short-term caution.

Factors Influencing TRX’s Price

TRON (TRX) Price Prediction: Path to $1 Clears With Technicals, Futures, and On-Chain in Sync

TRON's TRX token demonstrates resilience as it climbs back to the $0.36 zone, a critical level for future expansion. Analyst Crypto Patel notes a 50x growth from its launch price of $0.0068, with the weekly chart revealing consistent accumulation patterns. The rising trendline suggests a potential breakout toward $0.75, with $1 emerging as a psychological target this cycle.

Futures markets remain neutral, indicating balanced sentiment among traders. TRON's technical strength aligns with on-chain activity, reinforcing the bullish case. The absence of significant breakdowns in momentum indicators underscores the token's upward trajectory.

TRON Momentum Holds Steady, Could TRX Surge to $0.37 Soon?

TRON trades at $0.355 after a 1.76% dip, maintaining stable momentum despite losing steam from recent highs above $0.365. Analysts eye a potential breakout to $0.37 during KuCoin's TRON Carnival, fueled by rising liquidity and trading volumes.

CryptoQuant data reveals 3.426 billion TRX ($1.11B) moved, with futures markets signaling neutral positioning—suggesting room for upside before a local top forms. No speculative overheating detected since December 2024's rally from $0.26 to $0.45, indicating organic demand rather than leveraged speculation.

TRX Price Prediction: TRON Eyes $0.37-$0.40 Target as Bulls Aim for Breakout

TRON's TRX is showing signs of a bullish breakout, with technical indicators pointing to a potential rally toward the $0.37-$0.40 range within the next 2-4 weeks. Market sentiment is strengthening as buyers accumulate near key resistance levels.

The cryptocurrency's recent price action suggests growing confidence among traders, with momentum building for an upward move. Analysts are watching for a decisive break above current resistance to confirm the next leg of the rally.

Justin Sun Sues Bloomberg Over Alleged Breach of Crypto Privacy Agreements

Tron founder Justin Sun has filed a lawsuit against Bloomberg in the U.S. District Court for the District of Delaware, alleging the media outlet violated confidentiality agreements regarding his cryptocurrency holdings. The legal action seeks to prevent Bloomberg from publishing sensitive details about Sun's digital assets, which he claims were provided under strict confidentiality for inclusion in the Billionaires Index.

Sun asserts he only participated in Bloomberg's wealth ranking after receiving repeated assurances that his cryptocurrency wallet data would remain private. The lawsuit contends Bloomberg reneged on promises to limit public disclosure to a single aggregate figure, potentially endangering Sun's personal security. This case highlights growing tensions between crypto entrepreneurs and traditional financial media over data privacy norms.

TRON Price Holds at $0.35 Amid Buyback and Overbought Signals

TRON (TRX) has stabilized near $0.35 as technical indicators flash overbought warnings. The cryptocurrency's bullish momentum follows Tron Inc.'s record Q2 2025 earnings and a $1 billion buyback initiative, though profit-taking has introduced caution.

TRX currently trades at $0.35, up 1.29% in 24 hours, with its RSI exceeding 75—a classic overbought signal near critical resistance. The token's strength stems from fundamental drivers: a corporate turnaround yielding $1.47 million net income and shareholders' equity soaring 3,500% YoY to $111 million.

The August 4 buyback announcement catalyzed an 8% price surge, breaching $0.33. This capital deployment signals institutional conviction in TRX's long-term valuation, anchoring its position despite market volatility.

Is TRX a good investment?

Based on current technicals and news sentiment, TRX presents a speculative buy opportunity with a 3-6 month horizon. Key metrics to watch:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20-day MA | +2.46% above | Bullish bias |

| MACD | -0.002183 | Neutral momentum |

| Bollinger %B | 0.89 | Near overbought |

Mia advises setting stop-loss below $0.3377 and targeting $0.37-$0.40 if bullish momentum sustains.